It is time to talk about the elephant in the room: Why is ROI so elusive in analytics? Sure, it is difficult to quantify the value of analytics, but most businesses even struggle with the qualitative benefits. After decades of driving analytics at businesses in various industries around the globe, we would like to share the 7 most common reasons why analytics fails and guide you in doing better.

1.No Alignment between Strategy and Analytics

Unfortunately, analytics initiatives are very seldomly aligned with business strategy. There are two main reasons for that.

First, analytics is often delegated to Finance and IT where it is further delegated to lower levels of management. If you want your analytics to be aligned with your strategy, do not delegate but ensure active leadership from the highest level of management.

Second, strategy is often confused with goals. Achieving market leadership, product/service excellence, international expansion, product diversification, etc. are valid goals but they are not strategy. Goals are what you want, strategy is how you achieve them. No wonder almost all analytics initiatives are limited to monitoring business goals which is insufficient in a highly competitive world.

Michael Porter, arguably the most credible thinker about strategy, says there are “only two generic strategies: differentiation and cost leadership”. In order to earn excess profits, you either differentiate yourself sufficiently from the competition to have pricing power or you lead the competition by being the low-cost provider if significant differentiation is not possible.

Imagine a generic bank. Most of its services are commodities and highly regulated. It is very hard to differentiate significantly so most customers decide based on price and convenience. To earn excess profits the bank must do three things:

– Be the low-cost provider

– Make it easy for customers

– Manage risks

Some of the highest cost drivers for banks are capital and personnel costs along with IT and compliance costs.

– In order to drive down capital cost, a bank must attract low-cost customer deposits. In addition, it must manage risk more effectively so that it can borrow capital at attractive terms.

– In order to drive down personnel, compliance and IT costs and make it easy for customers to use its services, simple products, economies of scale and automation are essential.

A bank that relentlessly focuses on simplifying its customers’ lives with essential services that are easy to understand, manage and use and one that provides friendly customer-service is in a great position to become and remain the low-cost provider because it can attract customers at a low cost, gain economies of scale, spread mostly fixed IT and compliance costs across more customers to reduce costs even further.

This low-cost advantage is also beneficial for managing risks. On the one hand, simpler products are less risky operationally. On the other hand, having a lower cost-structure provides a bank with more flexibility to walk away from mispriced risks and only accept risks when they are priced correctly.

2. Starting with Your Data instead of Your Questions

How can I align my business and analytics strategy effectively?

The lack of alignment between strategy and analytics causes almost all companies to start with what they have (their data) instead of what they need (the questions they must answer to enable their strategy). In recent years for instance, there has been a huge and mostly misguided shift towards big data that has consumed resources, made businesses inward-looking instead of market-oriented and distracted most businesses from what is essential. No, data is not the oil of the 21st century! Unlike oil in the 20th century, data is not scarce, in fact we are drowning in data. In most cases we don’t need big data. What is truly scare and what we really need are big questions!

When businesses start with the questions they must answer, they often realize that they do not even have the relevant data needed to answer those questions. This type of high value data must often first be generated or acquired but it is very much worth the effort. At Business & Decision we apply a disciplined and methodical approach to identify the most important questions to drive your strategy, so will you measure what matters!

Now, you might point out that you are already struggling with the data you have, never mind the data you are missing. This brings us to our next reason why ROI is missing in analytics.

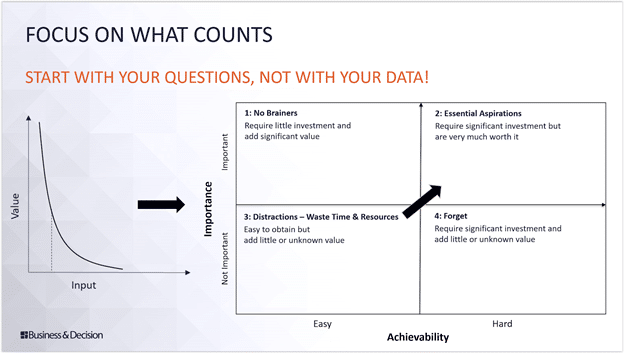

3. Lack of Focus – Power Law vs. Even Distribution

Too often, we assume the relevant inputs (the relevant questions) to be evenly distributed. Reality is, the competitive world is much more driven by the power law, where very few inputs contribute the most. Applied to businesses this means very few questions drive the lion share of business value – often referred to as the 80-20 rule, where 20% of the effort generates 80% of the value and the remaining 20% of the value requires 80% of the overall effort. The prevalence of the power law also stresses the need for leadership from the highest management level in analytics initiatives because executives can judge the impact of the relevant questions best.

Going back to our bank example, the most essential questions may be:

Target Customers:

Which customers types should we attract and serve based on our desired low-cost strategy?

Which types of customers should we try to avoid based on our strategy?

Is there a way to expand our market instead of fighting over the same pie?

What is our customer acquisition cost (CAC)? How can we improve it?

What is our customer life-time value (CLTV)? How can we improve it?

Product:

How can we radically simplify our products & services for our customers?

Are we achieving our simplicity goals in the perception of our customers?

Can we think out of the box for innovation by learning from other industries?

How much do our target customers trust us? How can we earn trust to lower CAC?

Promotion:

What do we stand for?

What sets us apart?

What can our customers expect from us? What should they not expect from us?How can we effectively communicate what we stand for to customers?

Place:

Where, when and how do we reach our target customers effectively?

Where, when and how do we serve our target customers effectively?

Price:

How do we price our products to attract customers and gain economies of scale?How do we best pass on gained cost efficiencies both to our existing customers to increase loyalty and CLTV as well as to new customers to lower CAC?

Partners:

Who do we partner with to achieve all the above more effectively?

Most of these questions either do not require much data or they require data about the market that businesses must first generate or acquire.

By concentrating on the questions with the highest business value potential rather than on existing data, businesses can create clarity and focus, avoid distractions, and prioritize.

As illustrated in the following diagram, it is relatively easy to start with the “No Brainers” in quadrant 1 and forget about the quadrant 4. Still, many firms invest in quadrant 4 when they engage in Big Data initiatives. But where most organizations fail, is that they get distracted with quadrant 3 initiatives and hence have no resources for the essential questions in quadrant 2.

4. Running before Walking – from Data to Value.

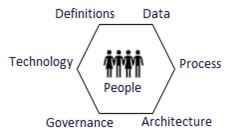

Understandably, businesses want to start analytics initiatives as soon possible to gain results, but experience shows that successful analytics requires preparation. It is important to assess your organization’s readiness, to identify gaps, and to close or bridge those gaps before you invest significant resources.

At Business & Decision, we assess organizations’ readiness based on seven dimensions: people, definitions (meta data), data, processes, architecture, governance and technology because these are common areas where shortcomings can derail analytics initiatives. Where necessary, we help businesses to bridge these gaps before they invest in initiatives.

5. Wrong/No Incentives

As long as artificial intelligence is not running business processes end-to-end (and arguably even then) incentives play an absolutely crucial role. Without the right incentives, even the best insights will not lead to desired actions. Therefore, businesses must always involve insight recipients early on to understand what motivates them and incentivize them accordingly.

We see time and again situations where there is a big divide forming harmful silos between business and IT and between departments. When people are incentivized to limit the sharing of data or information, they will. It is as simple as that. Effective incentives motivate people to do what is right for customers and for the firm both in form of individual contributions as well as in team work between colleagues, departments and business units. For all these reasons, incentives are a major component of our Readiness Assessment Solution at Business & Decision.

6. Starting Big

We can’t stress “Think big, start small!” enough for analytics. It does not cost much to think big, to have big ambitions and to focus on what is essential but analytics is multidimensional and complex. It is very difficult to anticipate the real world beforehand and many things can go wrong despite the best preparation.

We like to draw the analogy to drug discovery. Just like with drug discovery, it makes sense to experiment in an environment where mistakes can be made early and at low cost. This way you gain immediate feedback to learn from mistakes and can iterate rapidly until you have a proposition that stands the reality check technically, organizationally and of course business wise. A working proposition must also be tested end-to-end, after all, the most sophisticated customer segmentation may prove worthless if you do not have your customers’ email addresses.

At Business & Decision we apply a structured Data Lab approach to help our customers start small and nimble in order to de-risk analytics initiatives.

7. Just because You Built It, Doesn’t Mean They Will Come

The final shortcoming we observe in analytics is that businesses assume people will naturally use the analytics solutions they build. But in fact, Analytics solutions often fail to achieve broad usage. Usage rates below 10% are more common than you would think.

There are many reasons: We usually dislike change and are hesitant to learn something new. We also have other tasks and priorities. Oftentimes, analytics initiatives do not spend enough time and resources on UX design and usability for end users, on making sure the information presented is unambiguous and understandable and on fast response times. Because doing analytics is difficult it is too common to drop the ball at the end of the journey.

At Business & Decision, we like to involve the end users early on in what we call the Dashboard Design Workshop so we are aware of their needs and constraints from the beginning and can work towards lowering the entry barriers for them throughout the analytics initiative.

We hope we could give you valuable insights into the most common pitfalls stopping most business from achieving ROI in analytics and are glad to support you with your goals should you choose to get in touch with us.

Your email address is only used by Business & Decision, the controller, to process your request and to send any Business & Decision communication related to your request only. Learn more about managing your data and your rights.