At the conceptual core of every company there beats a heart that keeps the company alive. This heart is the customer value exchange. The concept is true if your company is large, small, somewhere in between, for-profit, not-for-profit, or a government organization. It is as true for your child’s lemonade stand as it is for the largest corporations in the world.

The value exchange is the sales transaction between your company and its customers. This transaction happens repeatedly over and over again. The health of the exchange transaction has a significant impact on the overall health and success of the business. If the transaction goes well then your customers are happy and your companies has a chance of long term success. Focusing on your customer value exchange is therefore a successful business strategy.

The Customer Value Proposition

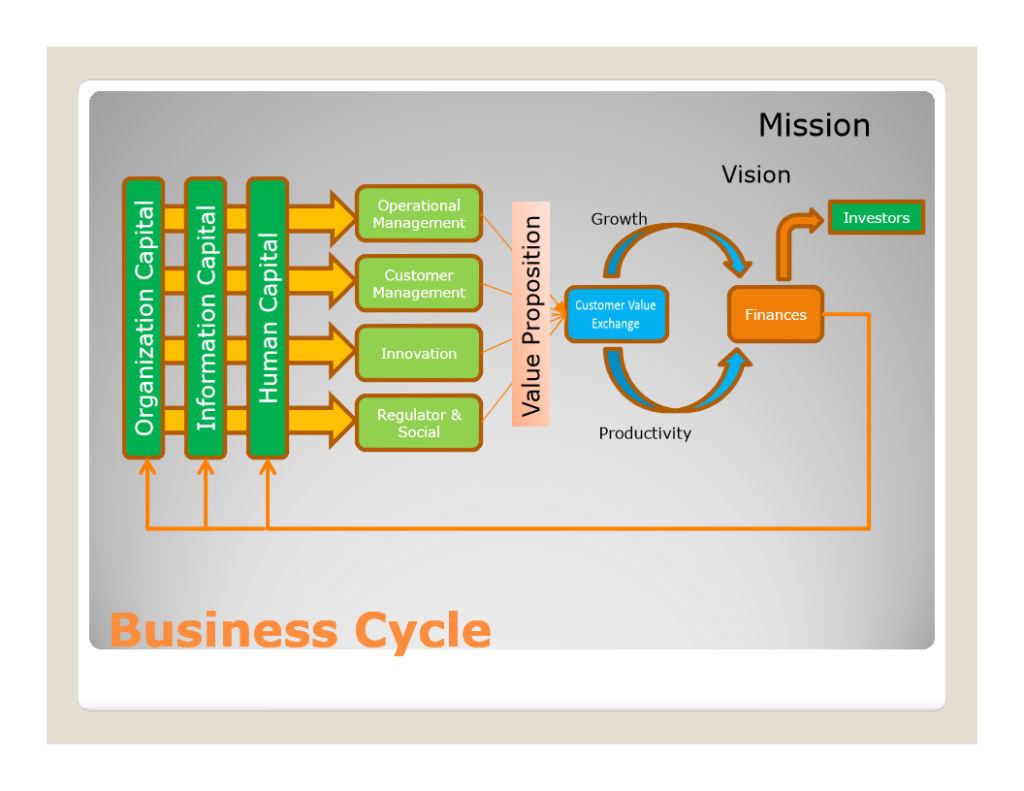

The management theory behind the customer value exchange has been around for a long time. The theory has been defined as the Customer Value Proposition (CVP) and has formed the core of marketing theory and the analysis of competitive advantage for the last 25 years. The body of knowledge around CVP is rigorous and detailed and has allowed the building of a robust business model serving as the basis for current Management Consulting and Business Strategy Analysis. The graphic below shows the Business Cycle Detail and the Customer Value Exchange at the “heart” of the business. The resources of the business (capital) are applied through the business processes and the value proposition to drive the Customer Value Exchange and subsequently the Finance section of the business.

It is somewhat surprising to learn that there is a new theory that radically changes the way we think of the customer value exchange. This new theory provides a paradigm shift in how the core mechanics of a business operates. The new approach changes how we model the customer value exchange and changes how all subsequent business effects are driven. This new model of the customer value exchange changes what we determine as a healthy properly functioning heart beat and what to do if the heart beat is not working properly.

Imagine if we had always thought of the heart as a single chamber beating away and then we learned that the heart was actually more complex and actually consisted of multiple chambers. That new knowledge would fundamentally change how we diagnosed problems of the heart and would alter our approach to establishing healthy heart functionality. That difference is analogous to the impact of the new knowledge that we now have regarding the customer value exchange. We now have a deeper understanding of the mechanics of the exchange and have fundamentally altered our concepts and expectations associated with the exchange. This new information is helping to create better diagnostics around the exchange and establishing a fundamentally new way to build and operate the business.

A New Approach

Under the new approach the customer value exchange stays in place. The CVP that describes what you do for your customers and determines why your customers, clients, and constituents come to your business stays in place. What changes is the perspective of the exchange from a business-owner centric view over to a balanced view between the business and the customer. The notion of a one-way transaction disappears and is replaced by a mutual exchange where value exchanges in both directions. There is detailed theory underneath this approach but basically the exchange becomes a mutual exchange of value and both parties contribute to the value exchange. The vendor receives value and the consumer receives value. Furthermore, at a detailed level the very notion of vendor and consumer both disappear and the parties are replaced by the notion of actors. The exchange then become an actor-to-actor exchange.

A key point in this new approach is that actors do not participate in the exchange to achieve tangible goods but rather participate in order to achieve an experience. The analogy is that people do not buy cars, computers, clothes, or phones to have them but rather they buy these things because of what the people experience when they use them. Businesses do not sell things to get money but rather the people running the business sell things to get the experience (personal recognition, personal satisfaction, or personal freedom). Money is simply a measure of a type of resource. The detailed theory discusses this distinction as differences in types of resources. The key takeaway with the concept of value as an experience is that the value becomes highly personal. It is therefore critical that businesses pay far more attention to the personal nature and impacts of the customer value exchange.

There are some fascinating additional fundamentals and corollaries with this new approach:

- All value is co-created at the time of the value exchange. Each actor is dependent on the other.

- Performance of the value exchange is easily measured and improved.

- There is no fundamental difference between products and service. Products are actually a special case of service and all exchanges are service exchanges.

- The value exchange can be federated and exchanges can be interconnected between internal and external exchanges. This structured model facilitates a more detailed and robust model for connecting the core of the business with the operation of the business.

The Good and Bad News…

There is good news and bad news with this new approach. The good news is that the approach appears to be sound and more accurately describes the realities of the customer value exchange. This accuracy will translate into better business results when the approach is applied to the management of the business. There is already a substantial body of knowledge associated with this approach. The naming of this approach by the original authors is Service Dominant Logic and the generic name applied by IBM is Service Science Management and Engineering.

The bad news is that there is more complexity to be understood and applied to the management of the business. Under the new approach there is a need for deeper analysis and attention to the customer value exchange. This deeper focus will take additional effort and will require changing some concepts and perceptions at the core of the business. The upside is, the businesses that apply this new understanding can expect a healthier heart at the core and a better performing business overall!

Comment (1)

Your email address is only used by Business & Decision, the controller, to process your request and to send any Business & Decision communication related to your request only. Learn more about managing your data and your rights.