In today’s world, you’d be hard-pressed to find an organization, private or public, that is not actively reconsidering the role played by data in its business model. Whether to ensure competitiveness, improve services offered or simply comply with regulatory obligations, there is a widespread consensus nowadays that data management is important, and not only have most companies already embarked on a digital transformation journey, but even the ones lagging behind recognize the urgent need to place data at the heart of their activity…

Data Governance: obtaining sustainable results

Placed high on the transformation agenda is of course the set-up of proper data governance, a prerequisite for managing data as an asset, i.e. as a source revenue. However, even when the resource requirements for such governance is fully understood, data governance implementation is too often approached like a simple project.

In so doing, and by only focusing on the transformative steps, organizations jeopardise investments made (which are sometimes quite substantial). And also lose sight of a key element of the whole transformation process: ensuring the sustainability of its results.

We could ponder on the reasons for which this usually happens, but it is highly likely that causes are context-specific. What this does indicate though is a general lack of understanding of the implications of data governance implementation. Even though most organizations recognise that digital transformation is necessary to better manage data, they often struggle with grasping the full organizational impacts of managing data as an asset.

This is quite surprising since the majority of companies have a solid understanding, through the management of their finances, of what it takes to properly manage an asset. And the fact that the elements required to manage finances are very similar to those needed to manage data makes it all the more surprising.

The 4 key components of successful data governance

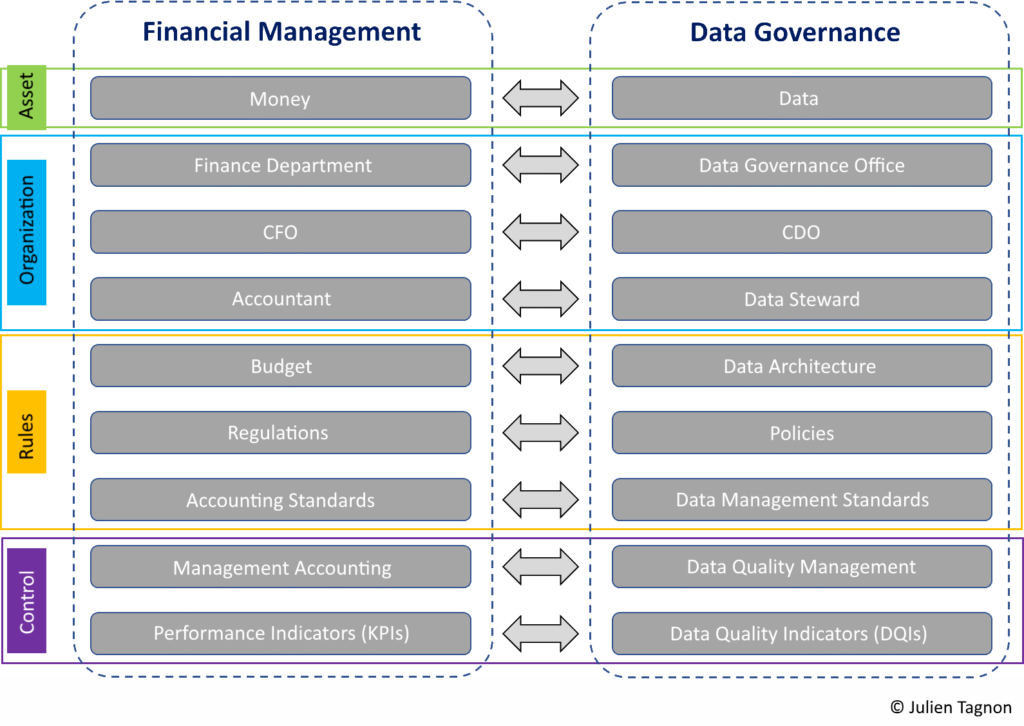

What are the pillars of data governance and what are their counterparts in the financial sphere?

1. The asset

Let us start by the most trivial aspect. Financial management and data governance both deal with the management of an asset: money in the first case and data in the latter.

2. The organization

Next comes the organization and the roles. An organization’s financial resources are managed within the finance department – the usefulness of which is undisputed – which provides cross-functional support. The Chief Financial Officer (CFO) heads the department and reports on the adequate and efficient mobilization of financial resources to ensure business continuity and growth in line with the organization’s strategy. Accountants, for their part, report to the CFO and are responsible for compliance with accounting rules and standards applicable to financial flows.

Data governance should not function any differently. Data should be managed as an asset by a dedicated department, providing cross-functional support (i.e. not restricted to business or IT). The department could, for instance, be named the Data Governance Office. Heading such a department would be the CDO (Chief Data Officer) playing his typical role and shouldering the responsibility for the adequate and efficient mobilisation of data to ensure business continuity and growth in line with the organization’s strategy. Compliance with data management rules and standards would be ensured by data stewards reporting to the CDO.

However, the CDO and CFO roles differ in that companies’ maturity level in the two areas is not the same. Whereas the CFO can limit his task to ensuring that finances are efficiently managed, the CDO must, for his part, not only set up and ensure that data is efficiently managed as an asset, but also liberalize data uses and thus act as an evangelist. It is more than likely that, as companies’ maturity level in data management increases, this evangelist role will gradually be replaced by a purely custodian one involving solely data management duties.

3. The rules

The allocation of financial resources to organizations’ various activities is neither random nor an “as and when requested” operation. It follows a predetermined, regularly reviewed, plan which takes into account expected earnings and approved expenditure amounts. This plan, commonly referred to as a “budget”, is the cornerstone of the resource allocation structure and the responsibility for compliance with it lies with the CFO.

The recording of financial inflows and outflows is done in accordance with accounting principles and laws, as well as accounting standards set by the organization to ensure overall bookkeeping consistency. The establishment and application of these standards fall of course under the responsibility of the CFO.

In the world of data governance, the distribution of data within the information system and the determination of master sources for each data item is not haphazard. It follows a well-defined plan, even if the said plan can and must evolve in order to support the organization’s activities. This is the role played by a data architecture, which is of course designed upstream based, on the one hand, on the organization’s needs, and on the other, on the rules and laws associated with data management (such as the GDPR) as well as the standards defined by the CDO to streamline the use of data and ensure overall consistency.

4. Control

It is also the finance department’s job to monitor the use and quality of the asset that it is tasked with managing. The role of management accounting is to focus on the interpretation of financial flows, the relevance of allocating financial resources to the organization’s various activities and the contribution of such allocation to organization performance, measured using previously defined key indicators. It is for the CFO to signal any problematic deviation from set objectives and to put corrective measures in place.

Quite logically, the Data Governance Office would hence operate on the same principle. Thanks to a data quality management process, it has a means of monitoring the quality of the asset for which it is responsible. The Office can then base itself on the quality level of the data to determine its contribution to organization performance, using data quality indicators previously designed to specifically measure the impact of data quality on the organization.

Just like his financial counterpart, it is up to the CDO to signal any significant deviation of the data quality level from the defined minimum level. The CDO is also responsible for putting corrective measures in place.

The figure below sums up the similarities between the financial management world and that of data governance.

This comparison shows that, when the aim of data governance is to truly consider data as an asset and to manage it as such, its implementation leads to sustainable deliverables such as organization, rules and means of control and evaluation. Moreover, an operational budget must be allocated in order to secure long-term sustainability.

Unfortunately, experience has shown that the far-reaching implications of the notion, which may seem quite straightforward, are rarely understood by organizations wishing to implement data governance. And this difficulty for companies to fully fathom the real scope of data governance implementation and their reluctance to embrace all the transformation impacts required to ensure sustainability condemn them to only approaching data governance as a project, confusing it with data cleaning, and thereby denying themselves most of the benefits that they could reasonably expect to reap from such an investment.

By contrast, organizations that understand that sustainable transformation outcomes are the key to transformational success will find themselves in possession of a unique asset; an asset that they will be able to capitalise on by launching new value-creating uses (AI, Data science, etc.). It is within such companies that “managing data as an asset” will no longer be a mere expression and will have finally taken on its full meaning.

Your email address is only used by Business & Decision, the controller, to process your request and to send any Business & Decision communication related to your request only. Learn more about managing your data and your rights.